Mastering Financial Management for Law Firm Growth

Written by

|

July 25, 2023

Written by Smokeball

|

July 25, 2023

Written by Jordan Turk

|

July 25, 2023

Running a successful law firm goes beyond legal expertise and requires effective financial management. From handling accounting challenges to establishing financially solid policies and optimizing key performance indicators (KPIs), every step in your legal team's business operations counts in achieving a stable and thriving practice.

Legal professionals that have not previously focused on this aspect of their legal business may need to clearly understand what feel-good financials look like or a reasonable roadmap to achieve financial bliss.

This comprehensive blog post fixes that.

When you're financially in good standing and in the black, you can do more good in the legal world while also feeling good about where your business stands. Below we explore the essential elements that can transform your law firm's financials from a tax-time nightmare to a feel-good financial situation while focusing on KPIs to drive growth.

Lay the Foundation for Financial Success

The Importance of Accurate Accounting Records

Accurate accounting records are the backbone of your firm's financial health. Access to real-time financial data and understanding your income, expenses, and financial statements can guide informed decision-making. Proper bookkeeping and accounting procedures make staying organized easier, increasing productivity and boosting profitability.

Circle Management Group's Expert Insights

Circle Management Group, founded by Laura Kennedy and Ken Kennedy, helps law firms evaluate their technology and financial decisions. While it's ideal to do some initial legwork to have your law firm's financial house order before investing in technology or other expenses, legal software solutions can often help with the tracking and reporting necessary to become organized and profitable without needing to devote hours upon hours to this aim every week.

Here are Laura's suggestions for setting up your law firm for success:

Cultivate Healthy Financial Habits

Budgeting, Cash Flow, and Cost Control

Many small law firms need to pay more attention to the budget required to run their practice successfully. Creating a comprehensive budget that includes costs for attorneys, life insurance, and personal expenses is crucial. Monitoring cash flow and promptly addressing accounts receivable aging can prevent cash flow issues that could negatively impact the firm.

Effectively addressing accounts receivable aging is crucial for maintaining a healthy cash flow and financial stability for law firms. When accounts receivable (AR) remain unpaid for an extended period, it can strain the firm's resources and hinder its ability to meet financial obligations. Here are some strategies law firms can implement to address accounts receivable aging effectively:

- Prompt Invoicing: Send out invoices promptly after services are rendered or as soon as possible. Delays in invoicing can lead to delays in receiving payments from clients. Use automated legal billing software to generate and deliver invoices on time.

- Clear Payment Terms: Clearly communicate payment terms to clients at the beginning of the engagement. Provide detailed information about due dates, accepted payment methods, and any penalties for late payments.

- Follow Up on Overdue Invoices: Implement a systematic process for following up on overdue invoices. Send gentle automated reminders with templated messages to clients as the due date approaches and follow up with more assertive communications if payments are not received.

- Offer Multiple Payment Options: Provide clients with multiple payment options, such as credit cards, electronic bank transfers, or online payment portals. Offering convenient payment methods can encourage prompt payments.

- Retainer Agreements: Consider using retainer agreements for some instances to ensure that a portion of the fees are paid upfront to help cover initial costs and reduce the risk of unpaid bills.

- Discount Incentives: Offer clients early payment incentives, such as discounts for settling invoices before the due date, to motivate clients to make timely payments and improve cash flow.

- Regular AR Reviews: Conduct periodic reviews of accounts receivable aging reports to promptly identify and address overdue invoices. This regular review helps prevent AR from accumulating and becoming unmanageable.

- Collections Policy: Establish a clear collections policy that outlines the steps to escalate overdue accounts, including when to involve a collections agency or pursue legal action.

- Improve Client Communication: Maintain open lines of communication with clients throughout the engagement by automated emails and other messages via your Client Portal on certain dates or milestones. With the right legal software, you can proactively communicate, and address any billing or payment concerns promptly to avoid disputes that may delay payments.

- Implement Automation: Utilize law practice management software or legal billing software that automate AR management processes. Automation can streamline invoicing, reminders, and tracking of payments.

- Client Screening: Conduct client screening to assess the creditworthiness of potential clients before taking on new cases. This screening can help avoid clients with a history of payment issues.

Read more: How Legal Client Intake Software Benefits Different Areas of Law

By implementing these strategies and maintaining a proactive approach to accounts receivable aging, law firms can improve cash flow, reduce financial stress, and ensure a more stable financial future. Regular monitoring and effective client communication are key to successfully managing AR aging and understanding your law firm's performance.

Financial Statements and Profitability

Mastering Financial Statements

Understanding financial statements is a critical component of financial management. Your law firm's income statement, balance sheet, and cash flow statement offer valuable insights into a firm's financial health. These statements help track revenue, expenses, assets, liabilities, and equity.

Law Firm's Income Statement

The income statement, also known as the profit and loss statement, provides a snapshot of a law firm's financial performance over a specific period, typically a month, quarter, or year. It shows the firm's revenues, expenses, and net profit or loss. Here's how the income statement offers valuable firm insights into a firm's financial health:

1. Tracking Revenue: The income statement shows the total revenue earned by the firm during the specified period. It includes income from billable hours, retainers, flat fees, contingency fees, and other sources. Analyzing revenue trends can help identify periods of growth or decline in the firm's income.

2. Analyzing Expenses: The income statement lists various expenses incurred by the firm, such as staff salaries, office rent, utilities, marketing costs, and other operating expenses. Understanding expense patterns allows the firm to assess its spending efficiency and identify potential areas for cost-saving.

3. Calculating Profitability: The income statement reveals the firm's net profit or loss by deducting total expenses from total revenue. A positive net profit indicates a healthy financial position, while a net loss suggests that the firm's expenditures have exceeded its revenue.

Read more:

Law Firm's Balance Sheet

The balance sheet, also known as the statement of financial position, provides a snapshot of a law firm's financial situation at a specific time. It shows the firm's assets, liabilities, and equity. Here's how the balance sheet offers valuable insights into a firm's financial health:

1. Understanding Your Firm's Assets: Assets represent what the firm owns and can include cash, accounts receivable (unpaid client bills), office equipment, and other property. Monitoring asset values helps assess the firm's liquidity and its ability to meet short-term obligations.

2. Assessing Your Firm's Liabilities: Liabilities represent the firm's debts and obligations, such as accounts payable (unpaid bills to suppliers), loans, and other liabilities. Tracking liabilities allows the firm to manage its debt and financial obligations effectively.

3. Evaluating Your Firm's Equity: Equity is the residual interest in the firm's assets after deducting liabilities. It represents the firm's net worth and reflects the owners' investments and retained earnings. A positive equity balance indicates a healthy financial position.

Law Firm's Cash Flow Statement

The cash flow statement tracks the firm's cash inflows and outflows over a specific period, typically a month, quarter, or year. It provides insights into how cash is generated and used in the firm's operations. Here's how the cash flow statement offers valuable insights into a firm's financial health:

1. Law Firm Operating Activities: This section shows the cash generated from the firm's primary operations, such as client payments, billable hours, and cash received from other income sources. Positive operating cash flow indicates that the firm generates enough cash to cover its day-to-day expenses.

2. Investing Activities: This section shows cash flows related to the firm's investments, such as purchasing office equipment or property. The positive cash flow from investing indicates that the firm is making strategic investments.

3. Financing Activities: This section shows cash flows related to the firm's financing activities, such as taking out loans or repaying debt. It also includes cash from capital contributions and distributions to owners. Analyzing financing activities helps assess the firm's reliance on external funding.

Securing the Financial Future of Law Firms

After analyzing these financial statements, law firms can take specific steps to secure their financial future. If the list below seems opaque or like too much for your firm's staff to manage, now's the time to consider investing in legal software that will track time and expenses, pull data reports and expedite the billing and payments processes.

Law Firm Budgeting and Cost Control

Develop a comprehensive budget that includes all revenue sources and accurately forecasts expenses. Implement cost-saving measures to ensure optimal use of resources.

Efficient Legal Billing and Collections

Streamline the billing process to reduce accounts receivable aging and improve cash flow. Encourage prompt payments from clients and manage outstanding invoices effectively.

Read more: Get Paid Faster with Automated Billing & Payments: Step-by-Step & At-A-Glance

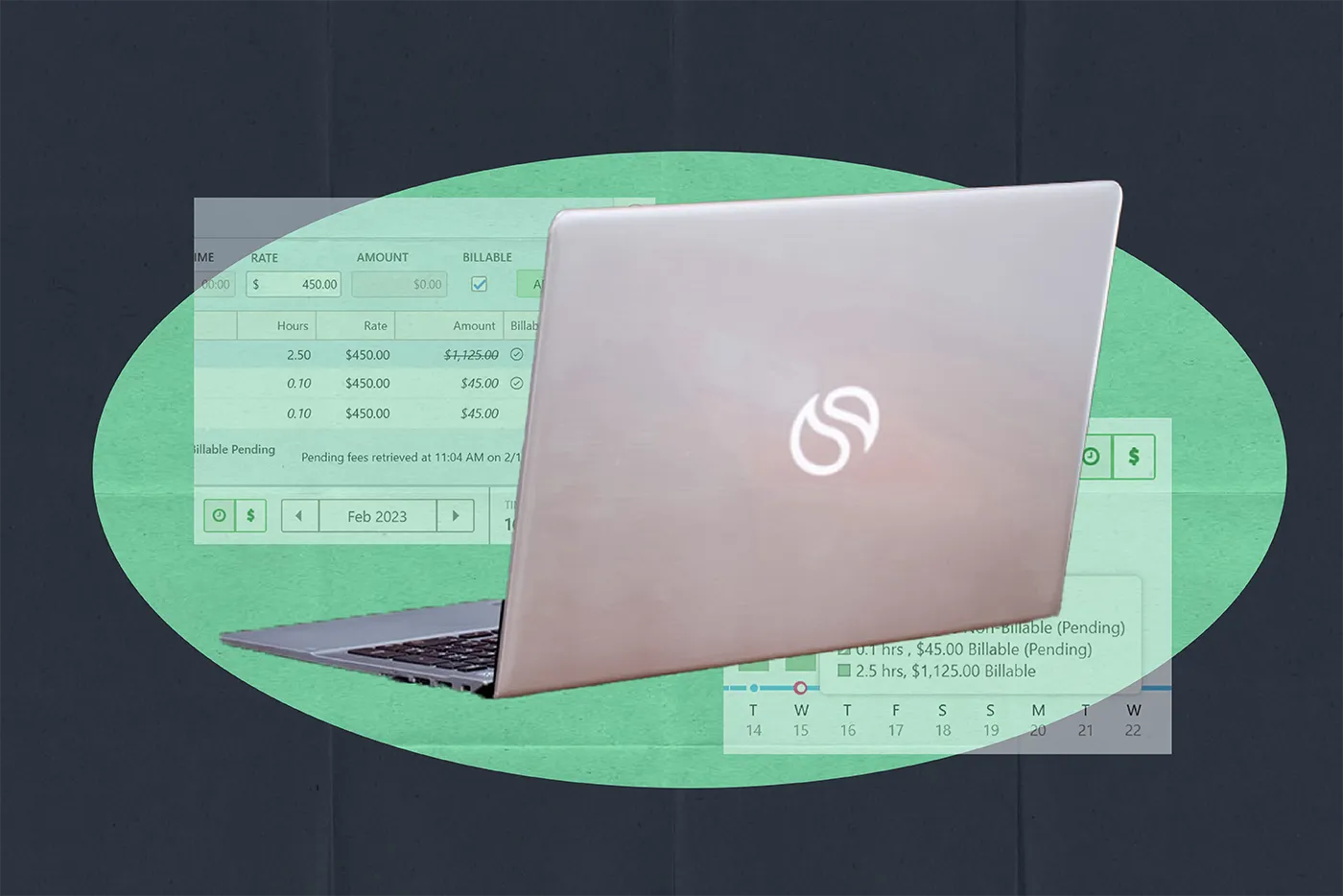

Investment in Legal Software

Invest in technology that improves efficiency, enhances client service, and helps manage law firm finances effectively. Integrated practice management software and billing systems can streamline financial processes.

Read more: How to Choose the Best Legal Practice Management Software

Strategic Legal Fee Pricing

Set pricing strategies that align with the firm's financial goals and consider case complexity, time and resource investment, competitive rates, client expectations and your law firm's current financial state.

Read more: Using Law Firm Data to Justify Billing Rate Increases and Legal Team Pay Raises

Law Firm Debt Management

Monitor debt levels and ensure the firm's debt is manageable and aligned with its growth strategy.

Diversification of Practice Area Revenue Sources

Seek opportunities to diversify revenue streams from various areas of law that present opportunities so your law firm can reduce reliance on a single source of income.

Read more: How to Pivot to Areas of Law Practice That Do Well in a Recession

Achieving Profitability So You Can Live Your Best Life

By taking these steps and regularly reviewing financial statements, law firms can make data-driven decisions, ensure financial stability, and secure their long-term success in an ever-changing legal industry.

Achieving profitability requires setting specific financial goals, aligning pricing strategies with business objectives, and monitoring progress regularly. Detailed reporting can provide crucial insights into case profitability, fee-earner productivity, and overall firm performance.

While tracking and organizing everything we discussed in this blog is possible with a manual process, legal software can reduce the time it takes to gather insights so you can carve a data-driven path forward. This clarity frees you up to focus on running a firm and continues to find new ways to make positive impacts for your clients and communities...or ensure you're present for the milestones in your personal life, too.

Download now: Double Your Billable Hours, Work Less

Evaluating Legal Software Investments

Viewing legal software as an investment, not just an expense, is vital for a firm's growth and security. Regular legal software updates, security measures, and leveraging technology to streamline processes can safeguard your firm against cyber threats and enhance efficiency.

Cybersecurity breaches not only cost your firm private data and legal fees, but they also cost your firm its reputation.

Read more: Why Cloud-Based Technology Is Necessary to Run a Cyber-Secure Firm

Not only will the right legal software help you rest assured that your data is reasonably protected, but you'll also gain the ROI from the legal technology itself. When your law practice management software integrates with the other legal software solutions you need, you'll have an easy-to-follow, highly automated legal workflow that makes billing and other administrative finance work a breeze.

How to Grow Your Law Firm

Download NowLearn more about Smokeball document management for law firms:

Book Your Free Demo

Ready to see how Smokeball client intake software helps you Run Your Best Firm? Schedule your free demo!

.webp)