Mastering Law Firm Compensation: The Rule of Thirds and the Power of Legal Billing Software

Written by

|

November 14, 2024

Written by Smokeball

|

November 14, 2024

Written by Jordan Turk

|

November 14, 2024

At Smokeball, we help law firms master law firm compensation by streamlining their Rule of Thirds through our innovative legal billing software.

For over a hundred years, the formula for achieving profitability in law firms has been consistent and surprisingly uncomplicated: set hourly rates as high as feasible to ensure that costs are covered — and profits are realized. This approach is relevant to all types of legal practitioners, from individual lawyers to small firms and even the largest legal entities. Historically, legal practitioners have relied on the rule of thirds to help them employ a balanced strategy for effective and profitable financial management.

The rule of thirds definition represents a conventional method for compensating and billing lawyers. It guarantees that the company meets its operational costs, fairly compensates its partners for their contributions and investments, and reserves a portion of profits to ensure future stability and growth. At Smokeball, we help law firms streamline their rule of one thirds and enhance their understanding of this concept through the use of legal billing software.

What is the Rule of Thirds for Law Firms?

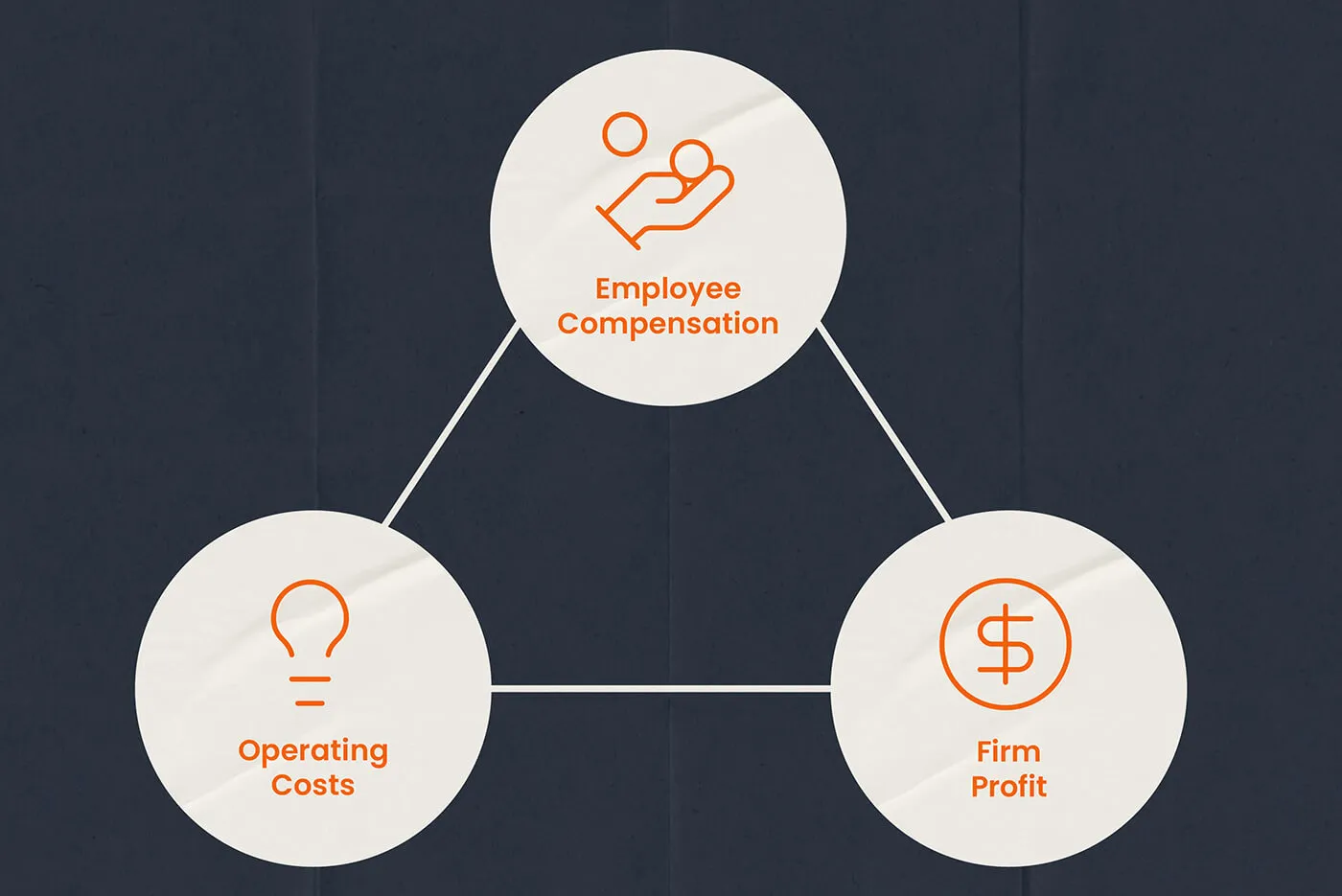

According to this principle, one-third of the revenue generated by an attorney's billable hours is allocated to the firm's overhead costs, another third is designated for partner profits, and the final third is assigned to the attorney's salary. Under this framework, an attorney should strive to generate approximately three times their salary in billable revenue for the firm.

This indicates that, at a minimum, your billable employees should create revenue that is three times their employment costs. Ideally, the billable team should achieve a revenue multiple ranging from three (3x) to five (5x). You may wonder why it’s advisable to aim for 5x when 3x suffices, but the answer is straightforward. The revenue generated by your billable staff must also cover the costs associated with your non billable personnel, such as your receptionist.

Billable Employees

Determining the right compensation for a new attorney — and managing the salaries of existing staff — can significantly influence a law firm's financial obligations. The revenue generated by billable employees is essential for funding the salaries of non-billable staff.

To ensure that billable employees are generating three times their salary, law firms can reference customized reports generated by legal billing software that helps them adhere to the "rule of thirds." This approach allows for a swift assessment of whether all billable employees are adequately covering the firm's expenses across all three categories.

- New Attorney (5x): New attorneys typically require more time to complete tasks than their more experienced counterparts, yet their billing rates are approximately half that of seasoned lawyers. Their compensation is contingent upon the hours they bill. To that end, they must produce five times their salary to align with their firm’s rule of thirds.

- Emerging Talent (4x): Attorneys who have been with the firm for over a year are expected to assist in client relations and mentor newer lawyers, which is reflected in their salary increases. Although these additional responsibilities may lead to a slight reduction in billable hours, their billing rates still tend to rise. That’s why they need to generate four times their salary to comply with the firm’s rule of one thirds.

- Accomplished Attorney (3x): Seasoned attorneys, often partners or firm owners, command higher billing rates due to their ability to attract new clients for junior attorneys. Their experience and ownership status position them as the only billable employees who genuinely adhere to the law firm's rule of thirds.

Non-Billable Employees

The truth is: meaningful tasks are not always billable.

While they do not directly generate revenue, non-billable employees play a crucial role in the development and functioning of a law firm — and their efforts create new income possibilities. It’s erroneous to classify these employees within the compensation framework. But, they should be recognized as overhead to uphold and illustrate the law firm's operational structure.

- Administrative: Employees dedicated solely to supporting office functions, without contributing to billable hours, should be classified as overhead expenses related to office management. These non-billable employees may include receptionists, assistants, billing administrators, office managers, and those who do the following crucial, if not billable, tasks: the opening and closing of files, mail distribution, sending emails, stamping documents, updating databases, courthouse running, invoicing, and similar duties. However, some of these tasks might be carried out by paralegals or attorneys, in which case they may be billed at their respective rates — contingent upon the nature of the tasks.

- Intake: A legal client intake process serves as a crucial instrument for law firms to collect relevant information from prospective clients, and then get them in the door. The process, typically involving a non-billable employee handling forms and communicating with potential clients, helps attorneys understand the client's situation, evaluate case feasibility, and maintain effective communication with potential clients. Salaries and benefits of employees tasked exclusively with managing intake forms and contact with these prospective clients should also be categorized as overhead expenses, reflecting their role in the firm's operational framework.

- Marketing: Although marketing holds significant importance for law firms, especially those in the personal injury realm, it’s often overlooked despite it being one of the best ways to grow your firm. It’s not billable, but it’s crucial to the success of the practice. By categorizing marketing expenses as overhead, a law firm can more accurately assess the return on investment for all marketing initiatives, extending beyond just pay-per-click, SEO, and website expenditures.

“Leveraging the cutting-edge utility of legal billing software to automate various non-billable tasks, including the management of the legal client intake process, enables attorneys to focus on their main goal — providing assistance to clients.”

— Hunter Steele, Smokeball Founder and CEO

The rule of one thirds should not be viewed as a rigid standard but rather a guideline. If your objective is to achieve swift growth, you might need to increase your marketing budget for a limited time. For example, some of our clients benefit from significantly low overhead and have chosen to allocate some of those funds towards offering his employees generous salaries.

Despite this, the organization still secures its one-third profit. Additionally, there may be times when you decide to temporarily reduce your profit margins to support growth initiatives. It’s crucial to keep a close watch on your spending to prevent falling back into a pattern of compensating others while neglecting your own financial needs.

Developing Compensation Structures for Attorneys

Embracing modern compensation models in law firms acknowledges the high-quality and valuable work performed by lawyers, partners, and staff on a daily basis, rather than merely focusing on the quantity of billable hours generated. This initiative begins with a documented compensation philosophy that clarifies the principles and reasoning behind the compensation strategy. Such a philosophy enhances transparency and sets clear expectations, which is often appreciated by team members.

Additionally, it encourages business owners to thoroughly evaluate their salary, bonus, and benefits offerings. Frequently, firm owners design compensation packages based on practices observed in other firms, often without a thorough understanding of the implications of their payment strategies — and the behaviors they are promoting.

Understanding Legal Billing Practices

The process of legal billing involves issuing invoices to clients for the legal services they have received. Law firms typically utilize various billing structures, such as hourly rates, flat fees, or contingency fees. Billable hours are defined as the time recorded by attorneys and other legal staff for work that is directly related to client cases.

Attorneys are encouraged to keep a meticulous record of their time while also ensuring that clients have a clear understanding of the billing procedures. A considerable percentage of a law firm’s time should be billable, as these hours are essential for the viability of many legal practices. This objective can be met through the accurate and efficient tracking and collection of billable time, often supported by advancements in legal technology.

Benefits of Legal Billing Software for Profitability

Profitability serves as a fundamental pillar within law firms, making the effective management of billing essential for reaching this goal. Historically, legal practitioners faced challenges with traditional paper-based billing systems, which were not only labor-intensive but also susceptible to inaccuracies. In contrast, the contemporary technological environment has introduced legal billing software solutions that provide a more accurate and efficient method for processing bills and invoices.

Smokeball offers legal billing software solutions to help law firms achieve operational success and benefit our communities. These tools minimize tracking time and expenses, expedite bill review, and streamline invoice distribution. Smokeball's law practice management software allows firms to bill at least two extra hours each day, generating $137,000 in revenue for each fee earner annually.

As the leading cloud-based software for legal practice management, our premium profit-boosting offering allows you to effectively oversee your firm in alignment with the specific demands of your legal specialty. In contrast to other legal billing software alternatives, Smokeball possesses the capability to transform your firm and enhance your business, regardless of your practice area.

Smokeball’s Legal Software Solution

Thousands of attorneys place their trust in Smokeball's legal billing software to increase profits for the long term. A diverse array of legal professionals in managing their practices effectively, and we are just getting started.

Learn what makes Smokeball different from the competition:

- Designed by attorneys for attorneys

- Powered by cloud technology

- Valued by an active community of legal professionals

Learn more about Why Lawyers choose Smokeball

What is Smokeball?

Recognized as the leading practice management software by G2, Smokeball provides exceptional features, outstanding service, and impressive outcomes. Become part of a dedicated community of thriving law firms that are witnessing enhanced productivity and profitability. Book a demo with a Smokeball expert to learn how your law firm can scale with legal billing software.

Learn more about Smokeball document management for law firms:

Book Your Free Demo

Ready to see how Smokeball client intake software helps you Run Your Best Firm? Schedule your free demo!